They think consumer confidence is resilient; I find that very hard to believe

Feds cut interest rate again

- Thread starter Arjun

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,423

- 27,577

They think consumer confidence is resilient; I find that very hard to believe

This Christmas I am giving people less .. including myself

tigerwillow1

Known around here

Intuitively, I think that a whole lot of inflation hasn't bubbled through the system yet. Caused by covid related spending, shoveling money into wars, and shoveling money for illegals. (Plus now the "continuing resolution" which is sounding like mostly new spending). Common wisdom would be that lowering interest rates will only make it worse. One thing I see locally is that Christmas tree sales have tanked. Lowes is running 25% off, and some individual lots have 50% off signs out. I fear that the individual small business people will end up losing money this year. At many of the lots a 6 foot tree is $100. For something you use only a few weeks, and for some pay more to have it hauled off, that's pretty steep. After shopping around I paid $90 for a 7-footer, which I could have had for half of that yesterday. Just one of many economic indicators.

bigredfish

Known around here

True inflation numbers arent being published and havent been for over a year

www.zerohedge.com

www.zerohedge.com

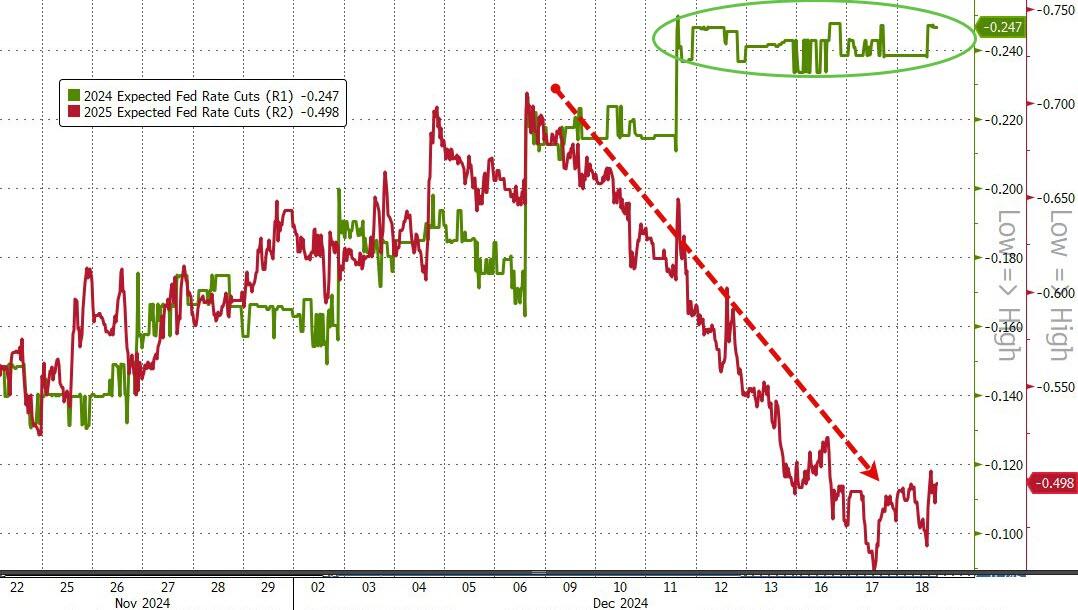

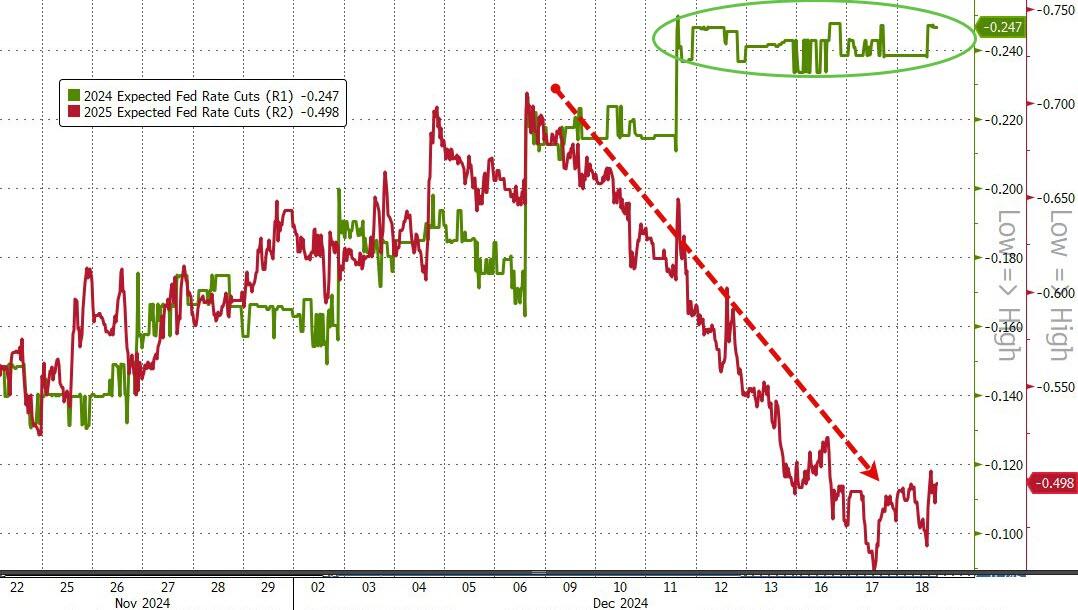

Just a reminder - The Fed slashed rates by a dramatic 50bps (crisis-like move) less than 3 months ago!! And now - post-election - things are completely different.

Most notable is the fact that inflation data has dramatically surprised to the upside and 'hard' data (excluding sentiment/surveys) has also soared since The Fed started its rate-cutting cycle...

The market is fully priced for a cut today but as the chart below shows, expectations for 2025 cuts have collapsed...

www.zerohedge.com

www.zerohedge.com

Watch Live: Fed Chair Powell Explains Why He Cut Rates Again As Inflation Data Surges | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Just a reminder - The Fed slashed rates by a dramatic 50bps (crisis-like move) less than 3 months ago!! And now - post-election - things are completely different.

Most notable is the fact that inflation data has dramatically surprised to the upside and 'hard' data (excluding sentiment/surveys) has also soared since The Fed started its rate-cutting cycle...

The market is fully priced for a cut today but as the chart below shows, expectations for 2025 cuts have collapsed...

Hawkish Fed Cut Rates As Expected; Signals Dramatically Less Aggressive Rate-Cut Cycle | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Sold shares before the Feds cut down interest rate; I knew this was going to happen; Dow Jones is down, oh and value of Bitcoin went down

bigredfish

Known around here

Quite the reaction in the markets at 2pm yesterday.

Down 1100 plus .. ouch.

Lovin my guaranteed 4.5-5.5% investments with zero market exposure today!

Down 1100 plus .. ouch.

Lovin my guaranteed 4.5-5.5% investments with zero market exposure today!

Ssayer

BIT Beta Team

Actually there is no such thing as zero market exposure as every financial institution is in the market, but I get what you're saying. I sold the last of my paper silver on it's last ramp up and brought it all home to our local bank as we're getting too old for market risk.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,423

- 27,577

bigredfish

Known around here

Actually there is no such thing as zero market exposure as every financial institution is in the market, but I get what you're saying. I sold the last of my paper silver on it's last ramp up and brought it all home to our local bank as we're getting too old for market risk.

CDs. Guaranteed annuities, TBills, certain brokerage accts that guarantee 5-5.5 % plus only upside exposure to the market, profits are locked in (yeah I never knew they existed either, but I had 0$ loss in the past 2 weeks of down market for example)

The only “exposure” I have is in a couple of 401Ks that are in MM/bond funds and while they can earn 0 they can’t go negative unless the govt goes literally bust or the alien invasion comes sooner than expected.

If my banks close the doors , I’m stil FDIC insured on all but about 20% of my entire nest egg. Meanwhile I’m making on average guaranteed 4.5-5% on the rest.

A note about Annuities. They can be complicated and I know just enough to be dangerous, But the ones I’m in are 5 yr guaranteed % (I can cash out anytime before with a penalty but after year#1.5 the interest exceeds the penalty. After 5 years you decide whether to use them as income or cash out and put the money somewhere else.

One of the best things I ever did was to buy whole life policies 20 years ago. We cashed them out recently as the life insurance was no longer needed. But the cash value was a pleasant addition.

#1 best thing I ever did, paying off all debt before retirement.

I am 41. Our mortgage origination date was 2016 and I am on track to have my house paid off around 2035, or sooner if I want to throw a lump sum at it at the end just to be done with it (remaining interest would be pennies, so not much saved in that regard). After that's paid off, unless I do something stupid, I'll be completely debt free. Now if I can just find a way to retire at 55...#1 best thing I ever did, paying off all debt before retirement.

Ssayer

BIT Beta Team

Just for perspective (and we're just looking at ONE of those 4,517 institutions here)...

"As of June 2024, the Federal Deposit Insurance Corporation (FDIC) had $129.2 billion in its Deposit Insurance Fund (DIF) and provided deposit insurance at 4,517 institutions"

"As of June 2024, Bank of America had $1,929,388,000 in total domestic deposits"

I think you get my drift...

We finished paying off our mortgage in 2005. So we're "good" in that respect. Do you think you really OWN that home? Don't pay your property taxes and get back to me on that one...

"As of June 2024, the Federal Deposit Insurance Corporation (FDIC) had $129.2 billion in its Deposit Insurance Fund (DIF) and provided deposit insurance at 4,517 institutions"

"As of June 2024, Bank of America had $1,929,388,000 in total domestic deposits"

I think you get my drift...

We finished paying off our mortgage in 2005. So we're "good" in that respect. Do you think you really OWN that home? Don't pay your property taxes and get back to me on that one...

bigredfish

Known around here

Quite true.

However, while I never planned for it or thought I would, due to Moms stroke and moving in with her, then selling our house at the top and moving into the swamp full time, we actually do own the house.

We don’t own the land, so I pay about $100 annually for registration, and $500 p/mo to rent the lot. No property tax, no mortgage.

I don’t miss it. That $ in the bank gives me much more peace of mind than owning 1/4-1/2 acre lot at our age

However, while I never planned for it or thought I would, due to Moms stroke and moving in with her, then selling our house at the top and moving into the swamp full time, we actually do own the house.

We don’t own the land, so I pay about $100 annually for registration, and $500 p/mo to rent the lot. No property tax, no mortgage.

I don’t miss it. That $ in the bank gives me much more peace of mind than owning 1/4-1/2 acre lot at our age

mat200

IPCT Contributor

- Jan 17, 2017

- 16,423

- 27,577

Lets hope the dollar currency does not crash in 2025

US dollar should remain stronger than most others.

While in my book us dollar is worth less than it was, other currencies are far worse.

IReallyLikePizza2

Known around here

I am 41. Our mortgage origination date was 2016 and I am on track to have my house paid off around 2035, or sooner if I want to throw a lump sum at it at the end just to be done with it (remaining interest would be pennies, so not much saved in that regard). After that's paid off, unless I do something stupid, I'll be completely debt free. Now if I can just find a way to retire at 55...

We are doing the same, trying to pay it off much sooner

I'm 30, mortgage origination was 2019 and we should have it done by 2038

Very glad to have purchased when I did. Everything went crazy right after

Hindsight being what it is, I wish I would have been just a touch more aggressive with payments in the beginning, but being ahead at all helps.We are doing the same, trying to pay it off much sooner

I'm 30, mortgage origination was 2019 and we should have it done by 2038

Very glad to have purchased when I did. Everything went crazy right after

jpc-s4

Getting comfortable

We are doing the same, trying to pay it off much sooner

I'm 30, mortgage origination was 2019 and we should have it done by 2038

Very glad to have purchased when I did. Everything went crazy right after

I'm older than dirt, have a huge mortgage, but in no way am I going to pay it early... At a rate of 2 7/8% with tax deductions on interest paid, I get more return on opening CDs with any spare $$$ (and keep the money more liquid) than if I were to pay off the mortgage early.

To me, this is the difference between good debt and bad debt. The mortgage is good debt, seeing that I have an appreciating asset and low rate. Bad debt would be credit card debt for anything but emergencies. Car loans would be somewhere in the middle, depending on circumstances.

IReallyLikePizza2

Known around here

I'm older than dirt, have a huge mortgage, but in no way am I going to pay it early... At a rate of 2 7/8% with tax deductions on interest paid, I get more return on opening CDs with any spare $$$ (and keep the money more liquid) than if I were to pay off the mortgage early.

To me, this is the difference between good debt and bad debt. The mortgage is good debt, seeing that I have an appreciating asset and low rate. Bad debt would be credit card debt for anything but emergencies. Car loans would be somewhere in the middle, depending on circumstances.

My reason for paying it off early is three fold,

1, its guaranteed money in the bank. It doesn't matter if the market tanks etc, I save that amount of interest no matter what

2, the stress reduction and great feeling of having a paid off house

3, probably the biggest, being able to drop the home insurance if they want to play funny games or play the "Your roof is old" nonsense. I'm totally done with that BS, the sooner I have no mortgage, the sooner that money can just go into savings. Home insurance in its current state is a legalized scam. You demand you pay all this money, then when you go to use the insurance they want to fight you on everything and then drop you after

jpc-s4

Getting comfortable

My reason for paying it off early is three fold,

1, its guaranteed money in the bank. It doesn't matter if the market tanks etc, I save that amount of interest no matter what

2, the stress reduction and great feeling of having a paid off house

3, probably the biggest, being able to drop the home insurance if they want to play funny games or play the "Your roof is old" nonsense. I'm totally done with that BS, the sooner I have no mortgage, the sooner that money can just go into savings. Home insurance in its current state is a legalized scam. You demand you pay all this money, then when you go to use the insurance they want to fight you on everything and then drop you after

I understand where you're coming from, and a lot of those reasons are personal (no "one size fits all").

That said, extra money paid into the mortgage is not really "money in the bank" because it's not liquid. If you need to access it, you'd need a HELOC or similar.

I, for one, cannot cancel my homeowners insurance, since the cost of rebuilding in my area is far too high. Of course, that may not be my choice, seeing how many insurers are dropping policies in my area...

IReallyLikePizza2

Known around here

I, for one, cannot cancel my homeowners insurance, since the cost of rebuilding in my area is far too high. Of course, that may not be my choice, seeing how many insurers are dropping policies in my area...

Me neither, and my home insurance is currently not TOO crazy, however I can see the writing on the wall

If you have a mortgage, they have you over a barrel

The odds of my house being destroyed beyond repair are pretty darn low, so if they want to get chummy I'll just cancel when the time comes