My insurance company checks the property every 10 years or so (been with them since 2001). They usually send out a letter about an inspection in 2 weeks, but they come out 1 week earlier...doesn't give you much time to clean things up. My roof was near the end after 24 years and planned to have it replaced this year, but inspector came out last June and said that my roof needs replaced or they would not renew in Oct. So I had it replaced earlier than expected...but should last my lifetime or I might get lucky and last longer than it

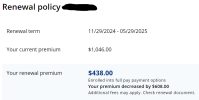

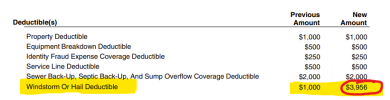

. Insurance been going up $50-100/yr but last two more like 200-500.

Our county re-assessed property early this year and just got my taxes, up about 20%...now let's see what my insurance will be in Oct. Luckily I'm in the county only, as it is an older community (no sidewalks, lights no HOA...but pay for water or well and garbage pickup), but all the newer housing is now incorporated into the city, so they have city taxes too. We are too small to incorporate, cost them more to do so than they'd get from us!. Thought this would be country enough out from work, but the build up in the last 10 years has been crazy as many people are looking beyond the local big City/County due to high taxes and house prices.

The Great Reset; we all know it is real, they don't hide their plans on their site. How do the Elites obtain property? Over Inflated House Values, High Taxes, High Mortgage Rates, High Home Owners Ins. which is required by Mortgage Companies...

The Great Reset; we all know it is real, they don't hide their plans on their site. How do the Elites obtain property? Over Inflated House Values, High Taxes, High Mortgage Rates, High Home Owners Ins. which is required by Mortgage Companies...