Knowing our gov't there could be some truth to this.

Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ssayer

BIT Beta Team

EMPIRETECANDY

IPCT Vendor

Ssayer

BIT Beta Team

DEVELOPING: Trading Halted at 30 Banks as Market Opens - NYSE Halts Trading at Charles Schwab | The Gateway Pundit | by Jim Hoft

Trading was halted Monday at numerous banks at market open.

Ssayer

BIT Beta Team

Barney Frank, the Namesake of the Behemoth Dodd-Frank Legislation, on Board of Failed Signature Bank | The Gateway Pundit | by Joe Hoft

Signature Bank, the firm that went under over the weekend, has an expert on its Board of Directors – Barney Frank.

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

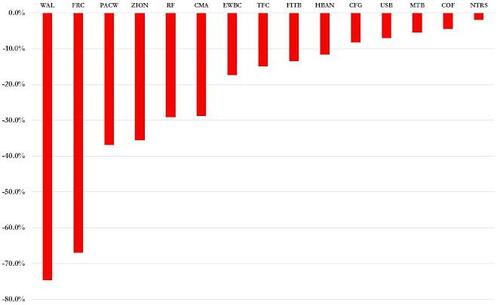

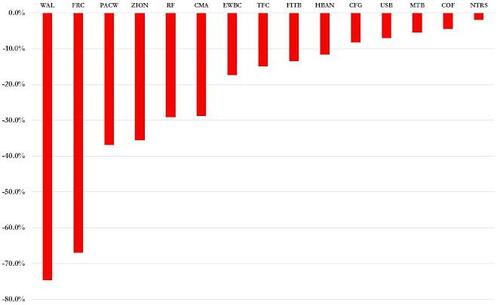

Small Banks Are Crashing

Small Banks Are Crashing | ZeroHedge

The take home here is that, unfortunately, Joe Biden's 9am pep talk did little to boost confidence in small US banks.

Or, as we put it earlier, ""It would be the Savings and Loan 2.0 Crisis but we regret to inform you there are no savings." Meanwhile, all hail JPMorgan, pardon, JPMega, which is about to have some $18 trillion in deposits.

Small Banks Are Crashing | ZeroHedge

- *FIRST REPUBLIC BANK HALTED FOR VOLATILITY, DOWN 65%

- *PACWEST HALTED FOR VOLATILITY; DROPPED 41% TO LOWEST ON RECORD

- *REGIONS HALTED FOR VOLATILITY AFTER PARING 31% DROP TO 20%

- *WESTERN ALLIANCE SINKS A RECORD 76%; HALTED FOR VOLATILITY

The take home here is that, unfortunately, Joe Biden's 9am pep talk did little to boost confidence in small US banks.

Or, as we put it earlier, ""It would be the Savings and Loan 2.0 Crisis but we regret to inform you there are no savings." Meanwhile, all hail JPMorgan, pardon, JPMega, which is about to have some $18 trillion in deposits.

Banks: The Eye Of The Hurricane?

Banks: The Eye Of The Hurricane? | ZeroHedge

Well, the US has $18 trillion in deposits, and recall that $42BN in SVB deposits were pulled in hours, not days, not weeks... hours. So, you'd have to forgive us if we are just a little skeptical that the Treasury's $25BN mini backstop bazooka and the FDIC's $125BN in bank run buffer will do anything to prevent a far bigger bank crisis now that the horses have fled the barn.

My guess is that this is the eye of the hurricane, rather than the all-clear. History doesn't repeat itself, but it does rhyme, and if you recall the collapse of Bear Stearns in March of 2008, the market climbed for a bit afterwards, and only started its precipitous decline after the collapse of Lehman Brothers six months later.

Banks: The Eye Of The Hurricane? | ZeroHedge

Well, the US has $18 trillion in deposits, and recall that $42BN in SVB deposits were pulled in hours, not days, not weeks... hours. So, you'd have to forgive us if we are just a little skeptical that the Treasury's $25BN mini backstop bazooka and the FDIC's $125BN in bank run buffer will do anything to prevent a far bigger bank crisis now that the horses have fled the barn.

My guess is that this is the eye of the hurricane, rather than the all-clear. History doesn't repeat itself, but it does rhyme, and if you recall the collapse of Bear Stearns in March of 2008, the market climbed for a bit afterwards, and only started its precipitous decline after the collapse of Lehman Brothers six months later.

Ssayer

BIT Beta Team

You knew it had to happen, right?

www.thegatewaypundit.com

www.thegatewaypundit.com

Joe Biden Blames Trump For Bank Failures and Broadening Contagion | The Gateway Pundit | by Cristina Laila

Joe Biden on Monday blamed Donald Trump for the recent bank failures and broadening contagion.

Looks like gold is one bright spot for the moment.

Good read and explanation of where we are…

Hudson: Why The Banking System Is Breaking Up

www.zerohedge.com

www.zerohedge.com

Hudson: Why The Banking System Is Breaking Up

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero