Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,496

- 27,717

ummm looks like something fishy here .. someone is getting played on this one, as those are mostly Chinese related ADRs and NOT USA Regional banks ..

LEJU = Leju Holdings Ltd HQ: China

SMFL = Smart for Life Inc HQ: Miami FL .. looks like a small company .. nutritional products, vitamins and protein powders ..

BAOS = Baosheng Media Group Holdings Ltd HQ: China

LXEH = Lixiang Education Holding Co Ltd - ADR HQ: China

SECO = Secoo Holding Ltd - ADR HQ: China

SO definitely a bit off .. PACW is the only USA Regional Bank in that list ..

So, more of China stock list ..

Ssayer

BIT Beta Team

Ssayer

BIT Beta Team

Maybe this one?

finance.yahoo.com

finance.yahoo.com

Western Alliance Bancorporation (WAL) Stock Price, News, Quote & History - Yahoo Finance

Find the latest Western Alliance Bancorporation (WAL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Yea I saw that too

Im watching

PACW

UCBI

ZION

NYCB

HBAN

CFG

Im watching

PACW

UCBI

ZION

NYCB

HBAN

CFG

Thats our corrupt Government getting rid of crypto - not that Im a fan, but they're clear;y going after it so they can introduce CBDC

mat200

IPCT Contributor

- Jan 17, 2017

- 16,496

- 27,717

Banks are probably getting hit today in USA due to expectations Fed will increase interest rates 1/4% again .. making all the Treasuries that the Fed forces the banks to buy worth even less now ..

Thus less profits for the banks .. if they have to report on their loses many would be unhappy with the results.

Oh, and those that can .. moving cash out of saving into better returns ..

Bank Runs are possible in this setup ..

Thus less profits for the banks .. if they have to report on their loses many would be unhappy with the results.

Oh, and those that can .. moving cash out of saving into better returns ..

Bank Runs are possible in this setup ..

I think they've had the .25 rate increase priced in, this is more about the bad shape a lot of banks are in due to the bonds they hold at 1% vs the current 5-6% AND the coming Commercial Real Estate sunami. FRC was the 2nd biggest failure since 2008 and the 4th in less than 2 months, and others are in similar shape.

Bank Bloodbath, Gold Soars as Anti-Goldilocks Manifests

Bank Bloodbath, Gold Soars as Anti-Goldilocks Manifests | ZeroHedge

Bank Bloodbath, Gold Soars as Anti-Goldilocks Manifests | ZeroHedge

Bank Bloodbath, Gold Soars as Anti-Goldilocks Manifests

Bank Bloodbath, Gold Soars as Anti-Goldilocks Manifests | ZeroHedge

Bet they even Blame it on the Crypto...Thats our corrupt Government getting rid of crypto - not that Im a fan, but they're clear;y going after it so they can introduce CBDC

Last edited:

But rob a bank with a pen and get 6 months at the "country club" of choice!

The Banking Collapse Of 2023 Is Now Officially Bigger Than The Banking Collapse Of 2008

The Banking Collapse Of 2023 Is Now Officially Bigger Than The Banking Collapse Of 2008 | ZeroHedge

Yes, you read the headline correctly.

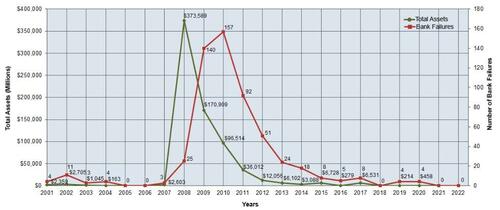

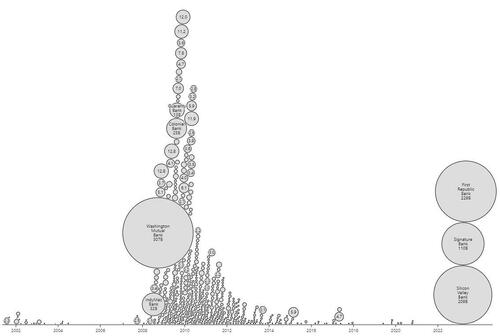

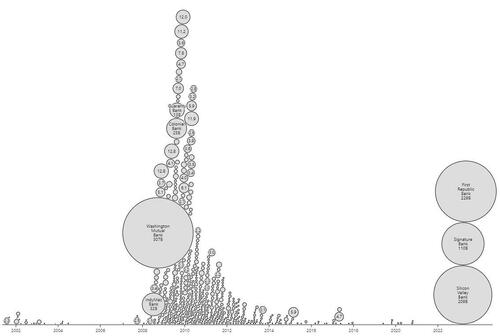

Collectively, the three big banks that have collapsed in 2023 had more assets than all 25 banks that collapsed in 2008 did.

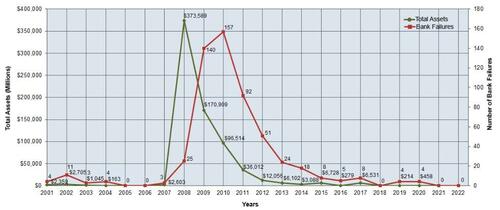

2008 saw the peak in terms of asset-size for bank failures ($373.6 billion with 'only' 25 failures), while 2010 saw the peak in number of banks failing (157 vs 25 in 2008).

So far in 2023, 3 banks have failed with combined assets of $548.5 billion.

Even including the $170.9 billion in assets from failed banks in 2009, 2023 is still worse than the two 'great financial crisis' years combined.

Source: ObservableHQ.com

Unfortunately, the banking collapse of 2023 is far from over.

We still have eight more months to go before this year is done, and many more banks are currently teetering on the brink of disaster. Executives at those banks are telling us not to worry, but of course executives at First Republic were issuing similar assurances just last week. Personally, I had heard that First Republic supposedly had enough reserves to keep going for months. But that was a lie, and now First Republic is toast. The following comes from the official statement that the FDIC issued when it took over the bank…

........

And the U.S. Treasury is telling us that the U.S. banking system “remains sound and resilient”…

It shouldn’t.

They always offer such platitudes before things start getting really bad.

As I noted at the beginning of this article, the three banks that have collapsed so far this year were collectively bigger than all of the banks that collapsed in 2008 combined…

The three banks held a combined total of $532 billion in assets, which – according to the New York Times and when adjusted for inflation – is more than the $526 billion held by all the US banks that collapsed in 2008 at the peak of the financial crisis

We are only one-third of the way through 2023.

And as Charlie Munger recently observed, many of our banks are absolutely packed with “bad loans” right now…

Charlie Munger believes there is trouble ahead for the U.S. commercial property market.

The 99-year-old investor told the Financial Times that U.S. banks are packed with “bad loans” that will be vulnerable as “bad times come” and property prices fall.

He is quite correct.

In particular, the collapse of commercial real estate prices threatens to create a massive tsunami of defaults…

And as mountains of commercial real estate loans go bad, a lot more banks will start to go under.

The “too big to fail” banks will scoop up those that they like, while others are simply liquidated and go out of existence.

Ultimately, I believe that we are going to see a wave of consolidation in the banking industry like we never have before.

We are still only in the very early chapters of this crisis. Much worse is yet to come.

The Banking Collapse Of 2023 Is Now Officially Bigger Than The Banking Collapse Of 2008 | ZeroHedge

Yes, you read the headline correctly.

Collectively, the three big banks that have collapsed in 2023 had more assets than all 25 banks that collapsed in 2008 did.

2008 saw the peak in terms of asset-size for bank failures ($373.6 billion with 'only' 25 failures), while 2010 saw the peak in number of banks failing (157 vs 25 in 2008).

So far in 2023, 3 banks have failed with combined assets of $548.5 billion.

Even including the $170.9 billion in assets from failed banks in 2009, 2023 is still worse than the two 'great financial crisis' years combined.

Source: ObservableHQ.com

Unfortunately, the banking collapse of 2023 is far from over.

We still have eight more months to go before this year is done, and many more banks are currently teetering on the brink of disaster. Executives at those banks are telling us not to worry, but of course executives at First Republic were issuing similar assurances just last week. Personally, I had heard that First Republic supposedly had enough reserves to keep going for months. But that was a lie, and now First Republic is toast. The following comes from the official statement that the FDIC issued when it took over the bank…

........

And the U.S. Treasury is telling us that the U.S. banking system “remains sound and resilient”…

Does reading that make you feel better?‘The banking system remains sound and resilient, and Americans should feel confident in the safety of their deposits and the ability of the banking system to fulfil its essential function of providing credit to businesses and families,’ a Treasury spokesperson said.

It shouldn’t.

They always offer such platitudes before things start getting really bad.

As I noted at the beginning of this article, the three banks that have collapsed so far this year were collectively bigger than all of the banks that collapsed in 2008 combined…

The three banks held a combined total of $532 billion in assets, which – according to the New York Times and when adjusted for inflation – is more than the $526 billion held by all the US banks that collapsed in 2008 at the peak of the financial crisis

We are only one-third of the way through 2023.

And as Charlie Munger recently observed, many of our banks are absolutely packed with “bad loans” right now…

Charlie Munger believes there is trouble ahead for the U.S. commercial property market.

The 99-year-old investor told the Financial Times that U.S. banks are packed with “bad loans” that will be vulnerable as “bad times come” and property prices fall.

He is quite correct.

In particular, the collapse of commercial real estate prices threatens to create a massive tsunami of defaults…

As I keep telling my readers, we really are on the verge of the largest commercial real estate crash in all of U.S. history.Berkshire Hathaway, where Munger serves as vice chairman, has largely stayed on the fringe of the crisis despite its history of supporting American banks through times of turmoil. Munger, who is also Warren Buffett’s longtime investment partner, suggested that Berkshire’s restraint is partially due to risks that could emerge from banks’ numerous commercial property loans.

“A lot of real estate isn’t so good anymore,” Munger said. “We have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There’s a lot of agony out there.”

And as mountains of commercial real estate loans go bad, a lot more banks will start to go under.

The “too big to fail” banks will scoop up those that they like, while others are simply liquidated and go out of existence.

Ultimately, I believe that we are going to see a wave of consolidation in the banking industry like we never have before.

We are still only in the very early chapters of this crisis. Much worse is yet to come.

As an Amazon Associate IPCamTalk earns from qualifying purchases.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,496

- 27,717

Sybertiger

Known around here

Where it stops....nobody knows. That should really kill the housing market.

www.foxbusiness.com

www.foxbusiness.com

Fed raises interest rates a quarter point, hints at possible pause

The Federal Reserve on Wednesday voted to raise interest rates for the 10th straight time but indicated that an end is in sight for its tightening cycle.

I think you’re going to see mortgage rates in the 5-6% range for a very long time. And arguably that’s where they should be. Recall in the 80’s they were double digits.

0-3% is too low and helped create the problems we see today, 15%+ is too high and will kill the market.

0-3% is too low and helped create the problems we see today, 15%+ is too high and will kill the market.

Sybertiger

Known around here

I think you’re going to see mortgage rates in the 5-6% range for a very long time. And arguably that’s where they should be. Recall in the 80’s they were double digits.

0-3% is too low and helped create the problems we see today, 15%+ is too high and will kill the market.

I read that 5.5% is the cutoff for so many people (who are younger) that think that is the "max normal" rate and will not purchase above that. They don't realize it isn't "normal". When I built my house I was at 9% and my student loan was also 9%.

Sybertiger

Known around here

I hope you are getting rich shorting these stocks.