Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

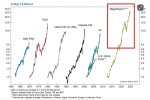

Is This Time Different?

Is This Time Different? | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Just spitballing here..

Lots of stories about Gold being pulled out of the Bank Of England, shortages/delays in physical delivery.

Also the revived story of how much Gold does the US REALLY have in Ft Knox?

news.sky.com

news.sky.com

www.zerohedge.com

www.zerohedge.com

It makes one wonder..

So lets just take a flying leap that Trump is going to pull away from the Federal Reserve, which like the Bank of England is a private for profit entity.

So lets say the Treasury decides to go back to a Gold Standard.

What do you price Gold at? (supposedly current reserves are valued at $43 or so p/oz even though physical is hanging around $2900 p/oz

Lets say there is about 5000 tons of Gold in Ft Knox.

Lets say they re-price Gold at $2500 p/oz to strip printing authority from the Fed.

How much $ is 5000 Tons of Gold at $2500 p/oz?

Lots of stories about Gold being pulled out of the Bank Of England, shortages/delays in physical delivery.

Also the revived story of how much Gold does the US REALLY have in Ft Knox?

The Bank of England gold rush that's pushing up the price

Sky's Ed Conway explains why the Bank's vaults have been seeing heavy outflows of the precious metal and what the consequences of this exodus are.

"Let's Do It": Rand Paul Supports Fort Knox Physical Audit After ZeroHedge Suggestion Goes Viral | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

It makes one wonder..

So lets just take a flying leap that Trump is going to pull away from the Federal Reserve, which like the Bank of England is a private for profit entity.

So lets say the Treasury decides to go back to a Gold Standard.

What do you price Gold at? (supposedly current reserves are valued at $43 or so p/oz even though physical is hanging around $2900 p/oz

Lets say there is about 5000 tons of Gold in Ft Knox.

Lets say they re-price Gold at $2500 p/oz to strip printing authority from the Fed.

How much $ is 5000 Tons of Gold at $2500 p/oz?

So 5000 Tons

A ton= 2000lbs

16 oz to a lb

I think its 400,000,000,000

I think thats $400 Billion?????

That's a few weeks or a months worth of what the government pisses away with usaid, the department of education, Ukraine and everywhere else.

Cut all funding to communist money laundering organizations.

For sure.

I think there's some fake info out there on Gold as well, and it looks like the big players are hoarding it

I think there's some fake info out there on Gold as well, and it looks like the big players are hoarding it

The US is Revaluing Gold, Hopefully Not Like in 1973

The US is Revaluing Gold, Hopefully Not Like in 1973 | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Flashback: Federal Reserve Refuses To Provide Records Of Foreign Gold Holdings

Flashback: Federal Reserve Refuses To Provide Records Of Foreign Gold Holdings | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

mat200

IPCT Contributor

- Jan 17, 2017

- 16,581

- 27,870

Maybe.

Then again if the economy tanks as I think it will, will demand tank at that price and force it back to $1.92?

Then again if the economy tanks as I think it will, will demand tank at that price and force it back to $1.92?

EMPIRETECANDY

IPCT Vendor

If the Gov't App will be free, assuming it will be, I am in, TurboTax Home & Business cost me $65-75 each year on sale.

Inflation will drop eventually, but the prices will not, as we have seen over the decades. Once the next greedy Gov't administration takes office and spends money like "Drunken Sailors" Karoline Leavitt quoteEgg price is too crazy… inflation will never down.

You'll Never Guess Why 'Spending' Plunged In January?

You'll Never Guess Why 'Spending' Plunged In January? | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Why the sudden plunge in spending?

Simple - goodbye USAID - and the billions of outflows to foreign nations...

tigerwillow1

Known around here

"U.S. pending home sales have fallen to a new all-time low"

Some of these pronouncements are hard for me to swallow. This index behind this claim was created in 2001, so I doubt that it can signal an "all-time low" of pending home sales.

I think I saw back to 1995. So 30 years is a long tiime

tigerwillow1

Known around here

Six years difference is a nit compared to all-time, but just for the record:

"An index of 100 is equal to the average level of contract activity during 2001, the first year to be analyzed."

Methodology: Pending Home Sales

"An index of 100 is equal to the average level of contract activity during 2001, the first year to be analyzed."

Methodology: Pending Home Sales

Might be different metrics, I didnt look that close

apnews.com

apnews.com

2024 US home sales hit lowest level in nearly 30 years with ownership increasingly out of reach

Sales of previously occupied U.S. homes fell in 2024 to a nearly 30-year low for the second year in a row as elevated mortgage rates, rising home prices and a low level of properties on the market kept many prospective homebuyers out of the market.