A little truth on Biden's tax plan - whether you like the truth or just like being gaslit by the gaslighter in chief.

From the Institute on Taxation and Economic Policy (ITEP) - an independent think tank. California, being affected the most is shown here as the example.

Biden’s plan would generate over $289 billion in tax revenue, according to

research from the Institute on Taxation and Economic Policy (ITEP). About 1.9% of the U.S. population would see an increase in taxes.

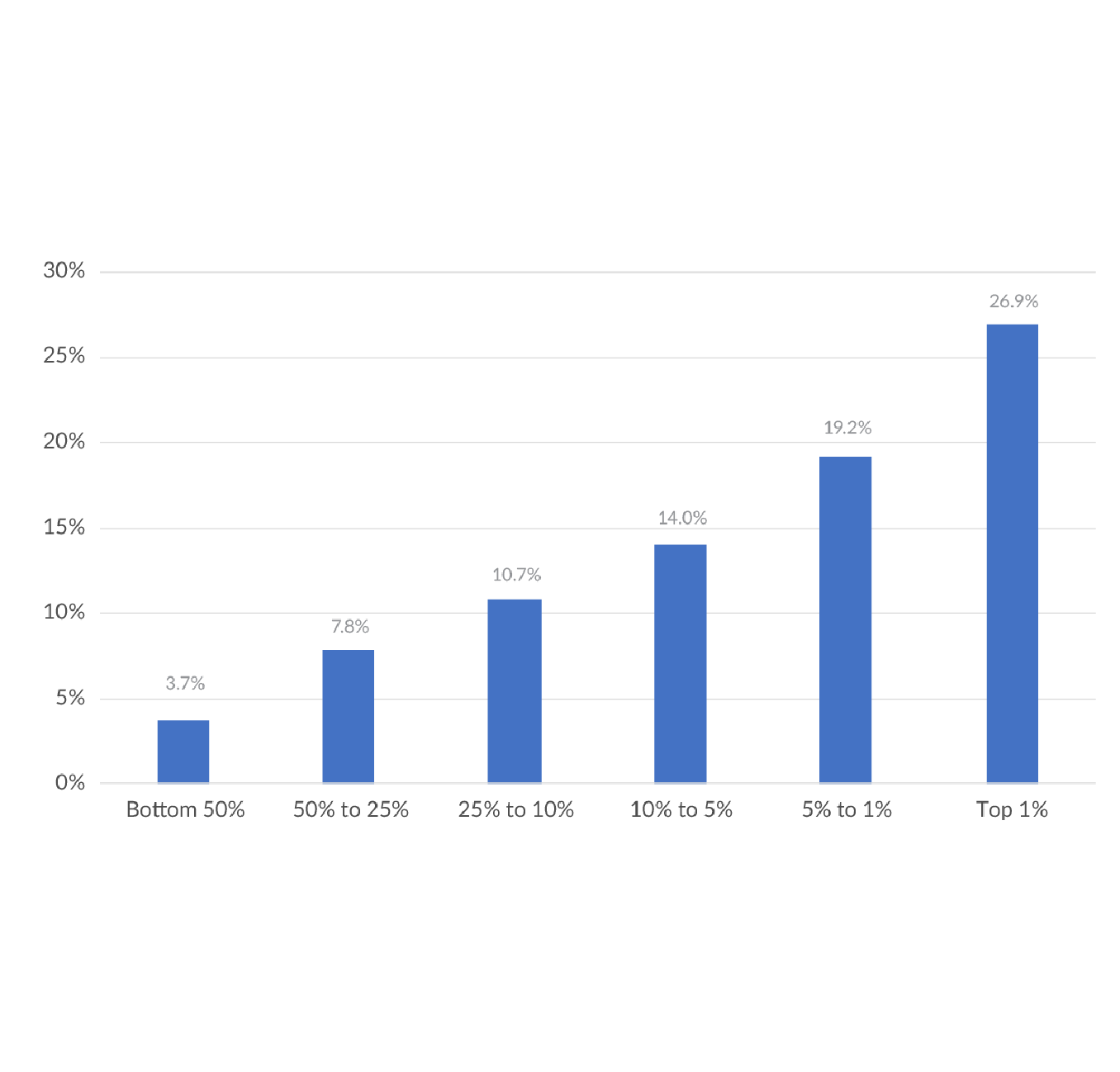

The top 5% would bring in most of the tax revenue. (Graphic: David Foster/Yahoo Finance)

The ITEP data broke down the impact by state. Population has a major impact on the overall total in tax increases.

Who actually pays

With its

massive population of over 39.5 million people and median income of $71,228, it’s no surprise that California would see the highest tax increases under Biden’s plan.

On Biden’s campaign website, it

states that “he won’t ask a single person making under $400,000 per year to pay a penny more in taxes.”

Here’s what the ITEP research shows.

On average, the bottom 95% in California will see no change in their taxes, even though collectively their tax bill may increase or decrease, according to ITEP. It’s those in the top 5% that will see a higher bill, with those making $347,200 to $948,300 a year paying $5,310 more on average each year. Those in the top 1% would see their tax bill increase by $279,300 on average.

How Californians would be impacted. (Chart: ITEP)

In total, the state would see a $54.6 billion more in tax revenue.

, so businesses can and will pass these tax hikes down to their employees and customers creating even more Over Inflated prices, while still remaining Rich,

, so businesses can and will pass these tax hikes down to their employees and customers creating even more Over Inflated prices, while still remaining Rich,