Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The craziest part of the Stock Market to me is it goes up and down based on everyone's predicting the future. Seems like an emotional rollercoaster, your money is in for a ride  "I have a Feeling"...sure I understand now computers are doing algorithms to predict the future, even future sales for companies.

"I have a Feeling"...sure I understand now computers are doing algorithms to predict the future, even future sales for companies.

Not putting the market down, while young you can take more risk, gamble all you want. In retirement, the wall goes up.

Not putting the market down, while young you can take more risk, gamble all you want. In retirement, the wall goes up.

tigerwillow1

Known around here

I've always called it white collar gambling.The craziest part of the Stock Market to me is it goes up and down based on everyone's predicting the future.

Behind Today's Stunning Jobs Report: A Record Surge In Government Workers

Behind Today's Stunning Jobs Report: A Record Surge In Government Workers | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Native vs foreign-born workers

And yet, it didn't take long to find what the BLS did this time to make the jobs appear much stronger than expected, a political imperative for the highly politicized agency tasked with making the Kamala/Biden economy appear stronger than it was exactly one month ahead of the election.

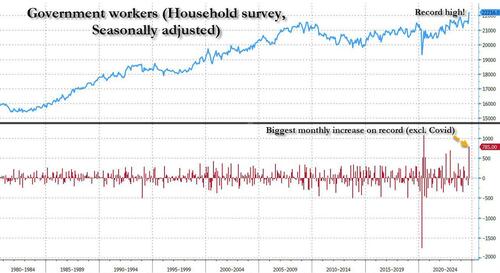

The answer, ironically, was in the number of government workers, which exploded higher, and were not only instrumental in pushing the Household Survey print much higher, but meant the difference between a 4.1% and 4.5% unemployment rate.

Here is what happened.

In September, the number of government workers as tracked by the Household Survey soared by 785K, from 21.421 million to 22.216 million, both seasonally adjusted (source: Table A8 from the jobs report). This was the biggest monthly surge in government workers on record (excluding the outlier print in June 2020 which was a reversal of the record plunge from the Covid collapse months before).

While government workers soared by the most on record, private workers rose by just 133K, a far more believable number, and one which however would indicate that the recent labor market malaise continues.

They won't tell you the economy is in shambles until after Trump gets elected.

www.zerohedge.com

www.zerohedge.com

...... how do you know it's an election year?

Retail Sales 'Reality Check': This Was The Biggest Positive September Seasonal-Adjustment Ever!

Retail Sales 'Reality Check': This Was The Biggest Positive September Seasonal-Adjustment Ever! | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

...... how do you know it's an election year?

All of those gov't numbers are politically fixed. CPI, Inflation, unemployment, on and on, just a bunch of political BS. Don't forget the 0.5% drop in Fed rates right when people get their mail in ballots. Yes, they KNOW people are that dumb. What number do you want to hear?

mat200

IPCT Contributor

- Jan 17, 2017

- 16,585

- 27,882

They won't tell you the economy is in shambles until after Trump gets elected.

Retail Sales 'Reality Check': This Was The Biggest Positive September Seasonal-Adjustment Ever!

Retail Sales 'Reality Check': This Was The Biggest Positive September Seasonal-Adjustment Ever! | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

...... how do you know it's an election year?

indeed .. whomever wins, will have a big bag to deal with

"US Recession Probability is at 57.06%, compared to 61.79% last month and 56.16% last year. This is higher than the long term average of 15.02%."

Report US Recession Probabilities - Estrella and Mishkin

Source Federal Reserve Bank of New York

It seems that the old benchmarks indicating a recession went out the window, because it wasn't a convenient time... prop it up and gaslight everyone to keep it going until after the election.

I was all set last year for the recession to happen and have the market tank so I can start buying, dollar cost averaging into the market again...because you can't predict the bottom. Did this in late 2007 to early 2008, slowly pulling about half into MM funds over this time. Didn't quite waited long enough for the bottom, as I started to slowly buy back into market around Oct. 2008. I wasn't about to get caught with my pants down like in the 2000-2002 DotCom venture.

venture.

I was all set last year for the recession to happen and have the market tank so I can start buying, dollar cost averaging into the market again...because you can't predict the bottom. Did this in late 2007 to early 2008, slowly pulling about half into MM funds over this time. Didn't quite waited long enough for the bottom, as I started to slowly buy back into market around Oct. 2008. I wasn't about to get caught with my pants down like in the 2000-2002 DotCom

venture.

venture.Income Inequality And Social Security

Income Inequality And Social Security | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Jobs Shock: October Payrolls Huge Miss As Private Jobs Drop For First Time Since 2020

Jobs Shock: October Payrolls Huge Miss As Private Jobs Go Negative For First Time Since 2020 | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

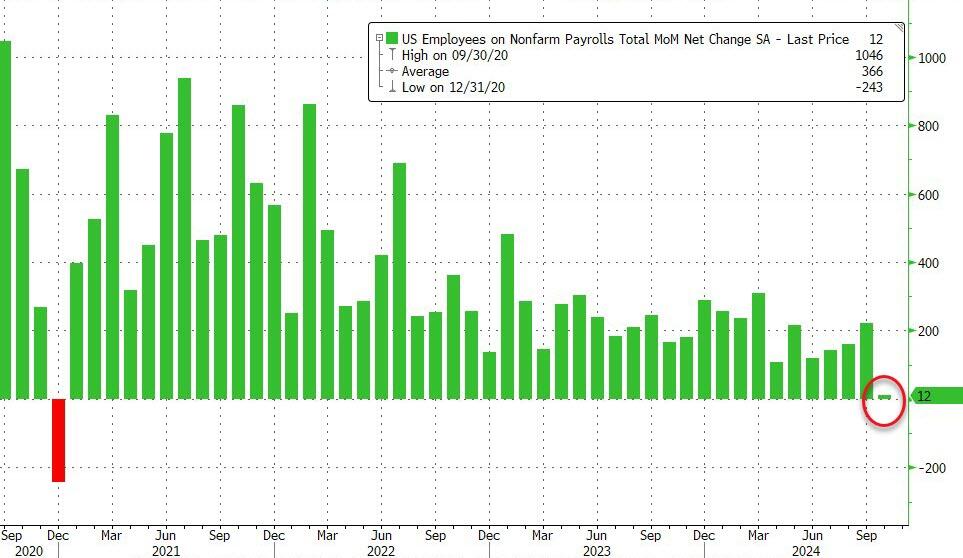

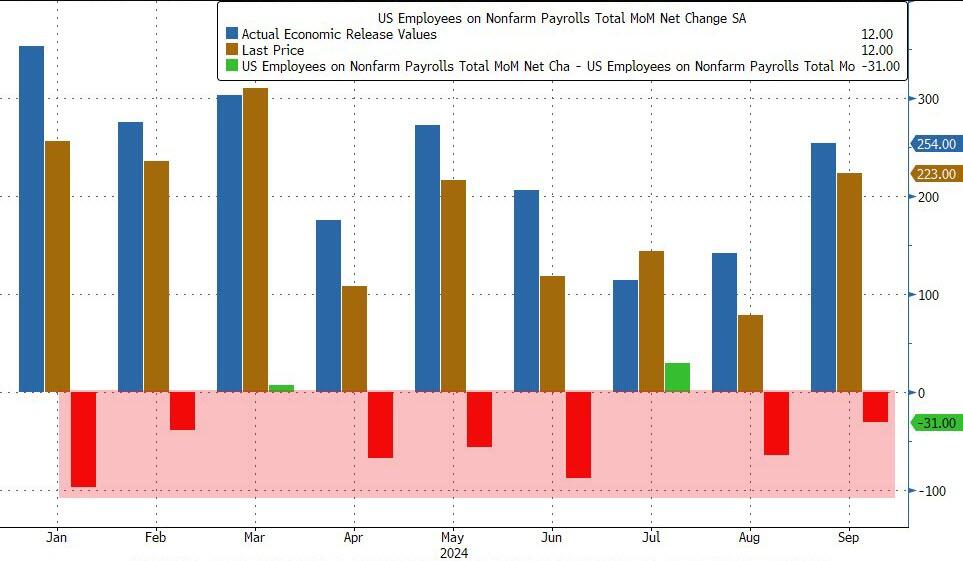

In our nonfarm payrolls preview last night, we said that the October payrolls report may show the first negative print since 2020. Well, moments ago the BLS reported the highly anticipated number and... it was close: the monthly print was only 12K, a huge drop from the pre-revision 254K in October (revised naturally lower to 223K), and just 13K away from a negative print.

And of course, as has been the case for the entire Biden admin, previous months were revised sharply lower once again: August was revised down by 81,000, from +159,000 to +78,000, and September was revised down by 31,000, from +254,000 to +223,000. With these revisions, employment in August and September combined is 112,000 lower than previously reported. This means that even after the monster September revision when 818K jobs were removed, 7 of the past 9 months were again revised lower!

This means that once the November jobs are released, we can be virtually certain that October will be revised to negative.

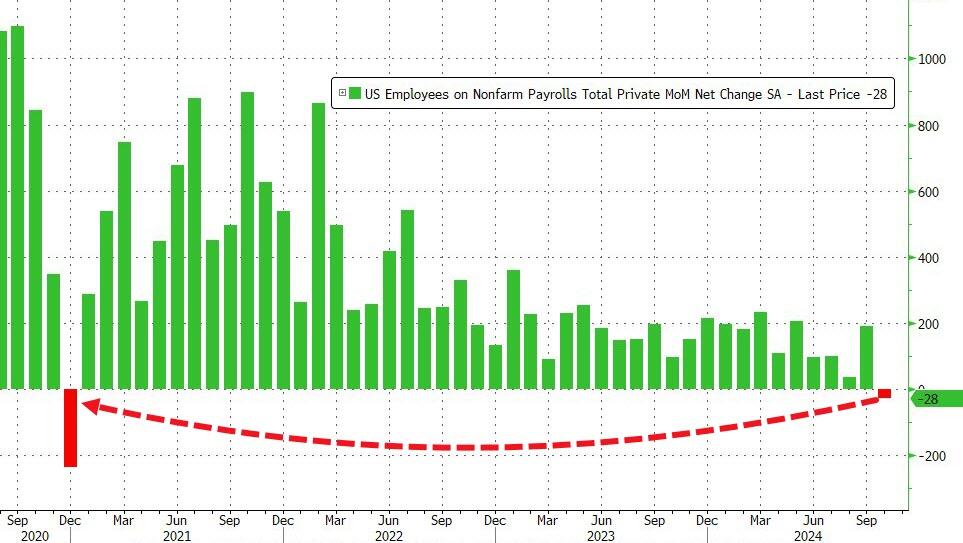

But wait, there's more because while the total payroll number was just barely positive, if one excludes the 40K government jobs, private payrolls was in fact negative to the tune of -28K, down from 223K pre-revision last month, and the first negative print since December 2020. In other words, we were right... when it comes to actual, non-parasite "government" jobs.

"They Just Got Handed Fraudulent Books" - Ed Dowd Confirms Our Warning That Trump Is 'Inheriting A Turd Of An Economy'

"They Just Got Handed Fraudulent Books" - Ed Dowd Confirms Our Warning That Trump Is 'Inheriting A Turd Of An Economy' | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Why is the Fed cutting rates with a record high DOW? Maybe they see the same thing he does. Dowd explains, “Real weekly wage growth was minus 2% going into the election. It is also interesting to know that minus 2% number of wage growth was also in 1980 when Ronald Reagan won in a landslide and also in 1992 when Bill Clinton won in a landslide..."

I have never seen such blatant manipulation of government statistics.

There is government spending and government hiring to paper over what is truly a bad economy for the average man. When I was asked prior to the election who do you think will win the election, I said Trump has already won, according to the economic statistics. That’s why he won. Bobby Kennedy helped along with Elon Musk, Joe Rogan, lots of people switching and what have you. What really got Trump in was the economy, the real economy, not the stock market.

It was not the ‘everything is hunky-dory’ pablum from the mainstream media.

The real economy has been rolling over, and we are just waiting for the financial markets to figure this out.

When they do, Trump is going to inherit a turd of a financial market crisis.

Government statistics will be updated, and it will show we started a recession sometime this year...

The incoming Trump Administration has to get out in front of the narrative. This was already baked into the cake. They just got handed fraudulent books. So, they are basically going to get blamed for what is coming.

They have to get in front of the narrative and talk about what they were handed. They need to talk about how the stock market is not a real indicator of economic health like it was before the days of raw manipulation

Not so fast.

I'm meeting with my JPM broker Monday. He seems to be a pretty good and smart guy. Not pushing me to be heavy in the market.

I told him they've been cooking the books for over a year to make employment and inflation look good. Interest rate decisions have been made on bad information. Now Powell is saying, mebbe we slow down on rate cuts... I'll be staying in short term bonds and Treasurys

M5%GA

www.zerohedge.com

www.zerohedge.com

Treasury yields exploded higher on Powell's comments, led by the short-end...

Source: Bloomberg

I'm meeting with my JPM broker Monday. He seems to be a pretty good and smart guy. Not pushing me to be heavy in the market.

I told him they've been cooking the books for over a year to make employment and inflation look good. Interest rate decisions have been made on bad information. Now Powell is saying, mebbe we slow down on rate cuts... I'll be staying in short term bonds and Treasurys

M5%GA

Fed Accompli Fail: Powell Pontification Prompts Puke In Stocks & Bonds | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Treasury yields exploded higher on Powell's comments, led by the short-end...

Source: Bloomberg

This.

If you've been dialed into interest rates, it became obvious that the debt was going straight up and that it was all short term Treasuries.

If you've been dialed into interest rates, it became obvious that the debt was going straight up and that it was all short term Treasuries.

First he tells the crackhead hobbit to lob missiles into Russia and now he's opening the floodgates for illegals.

Last edited:

^^ Trump should let the DHS and ICE folks know that if they follow through with this, they will have no jobs when he gets in.

Probably an unnecessary post, most people watching this thread watch the market much closer than I do.