Endgame: Interest On US Debt Surpasses $1 Trillion For First Time Ever, Exploding August Budget Deficit To Record High

www.zerohedge.com

www.zerohedge.com

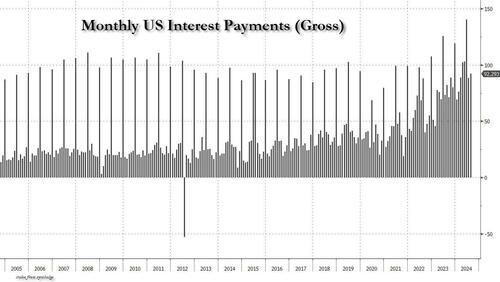

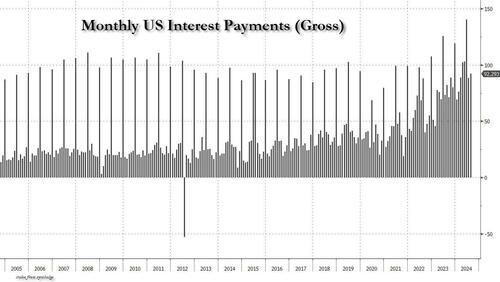

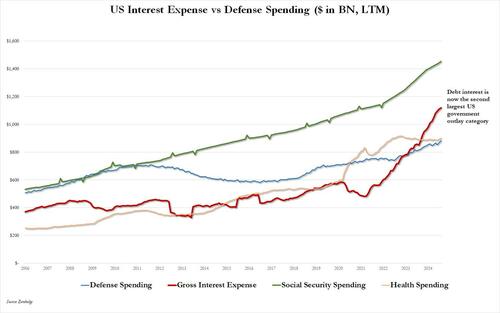

…..Yet looking at the dire big picture, it is unfortunately all downhill from here for one simple reason: we have now crossed the Minsky Moment in terms of how much the US spends on interest on its debt, which as regular readers know is hitting a new record high every day - it just closed above $35.3 trillion - and is growing by about $1 trillion every 100 days. That means that with interest rates at 40 year highs, the prediction we made last July, has finally come true because according to today's Budget statement, the amount spent on gross interest in August was $92.3 billion...

... which means that the cumulative total for Fiscal 2024 - where there is one more month to go until the end of the fiscal year (which ends Sept 30) - just hit an all time high of $1.049 trillion, the first time in history when interest on US debt has surpassed $1 trillion.

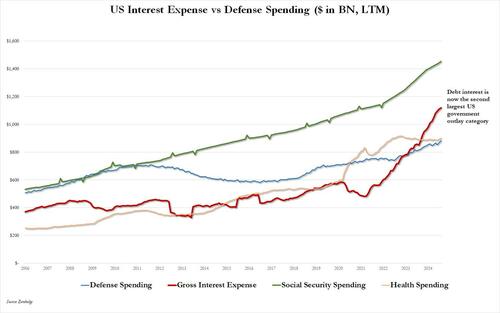

... and the stunning punchline is that as of today, gross interest on US debt has surpassed not just Defense spending, but also Income Security, Health, Veterans Benefits and Medicare, and is now the second biggest outlay of the US government, second only to Social Security, which is roughly $1.5 trillion annualized.

But wait, there's more: the latest numbers confirm that we are well on our way to hitting our other forecast from April 1, of the US hitting an insane $1.6 trillion in interest expense by the year-end...

….which mean interest expense will soon surpass Social Security spending and become the single largest outlay of the US government, some time in late 2024 or early 2025 at the earliest.

In other words, game over.

Which begs the question: why would Trump even want to be in charge when the house of cards finally comes crashing down. Let Kamala have it...

Endgame: Interest On US Debt Surpasses $1 Trillion For First Time Ever, Exploding August Budget Deficit To Record High | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

…..Yet looking at the dire big picture, it is unfortunately all downhill from here for one simple reason: we have now crossed the Minsky Moment in terms of how much the US spends on interest on its debt, which as regular readers know is hitting a new record high every day - it just closed above $35.3 trillion - and is growing by about $1 trillion every 100 days. That means that with interest rates at 40 year highs, the prediction we made last July, has finally come true because according to today's Budget statement, the amount spent on gross interest in August was $92.3 billion...

... which means that the cumulative total for Fiscal 2024 - where there is one more month to go until the end of the fiscal year (which ends Sept 30) - just hit an all time high of $1.049 trillion, the first time in history when interest on US debt has surpassed $1 trillion.

... and the stunning punchline is that as of today, gross interest on US debt has surpassed not just Defense spending, but also Income Security, Health, Veterans Benefits and Medicare, and is now the second biggest outlay of the US government, second only to Social Security, which is roughly $1.5 trillion annualized.

But wait, there's more: the latest numbers confirm that we are well on our way to hitting our other forecast from April 1, of the US hitting an insane $1.6 trillion in interest expense by the year-end...

….which mean interest expense will soon surpass Social Security spending and become the single largest outlay of the US government, some time in late 2024 or early 2025 at the earliest.

In other words, game over.

Which begs the question: why would Trump even want to be in charge when the house of cards finally comes crashing down. Let Kamala have it...

Last edited: