How regular people are fewking up WALL STREET HEDGE FUNDS

- Thread starter rahhazar

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

bigredfish

Known around here

Citi Warns Of ETF Distortions Due To Gamestop Surge | ZeroHedge

GameStop’s surge over the past two weeks has prompted Citi analysts to warn investors that some ETFs are facing distortions due to an outsized influence from the video-game retailer as its boom has altered their composition and may force "ad-hoc rebalances and strategy adjustments", Bloomberg reports.

GameStop’s surge over the past two weeks has prompted Citi analysts to warn investors that some ETFs are facing distortions due to an outsized influence from the video-game retailer as its boom has altered their composition and may force "ad-hoc rebalances and strategy adjustments", Bloomberg reports.

bigredfish

Known around here

GameStop, AMC halted after a minute of trading as shares retreat from massive gains

GameStop, AMC halted after a minute of trading as shares retreat from massive gains

GameStop, AMC halted after a minute of trading as shares retreat from massive gains

bigredfish

Known around here

Ssayer

BIT Beta Team

This is what happens when those in control play their hands too strong. People get red pilled. If they can't regain control, it certainly will be game over. I'm thinking how easily they could kill SLV and all the longs by simply having it default (they could do this with others as well) and then giving the little people a scapegoat to make it look like they're doing something good. We'll see...

bigredfish

Known around here

bigredfish

Known around here

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

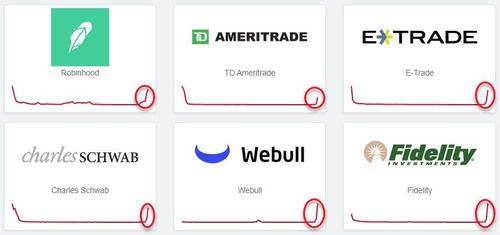

As retail panic trades most shorted stocks, a widespread outage of popular brokerage houses is being reported as the cash session begins. This seems to be the norm in the last couple of sessions, preventing some retail traders from participating in massive squeezes of Gamestop and AMC.

Downdetector reports Thursday morning that users of Robinhood, TD Ameritrade, E-Trade, Charles Schwab, Fidelity, and Webull are reporting issues and outages.

On a geographic level, users of Robinhood are experiencing problems and outages across the East Coast.

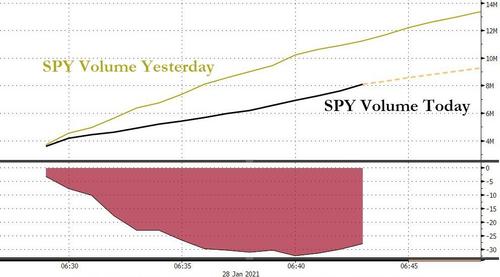

A simultaneous (and some have said coordinated) outage of many popular retail brokerage platforms and apps seems odd given that volume is 30% below yesterday's.

Mission accomplished? Shut retail traders out of markets for stability reasons? After all, Wall Street can't be embarrassed by another retail induced short squeeze of popular stock names that blows up even more heavily levered hedge funds.

Ssayer

BIT Beta Team

I just logged in there to check. It seems ok here, but then I don't have any money available for trading so there's that...

bigredfish

Known around here

handinpalm

Getting comfortable

bigredfish

Known around here

Ssayer

BIT Beta Team

bigredfish

Known around here

Ssayer

BIT Beta Team

bigredfish

Known around here

bigredfish

Known around here

Robinhood blocks new purchases of GameStop stock

Robinhood, the online trading application, is preventing users from making new purchases of several stocks, including GameStop Corp. GME, -24.03%, which have surged in value in recent weeks even as professional investors continue to hold large short positions in those securities, the company said in a blog post Thursday.

“We continuously monitor the markets and make changes where necessary,” the statement reads. “In light of recent volatility, we are restricting transactions for certain securities to position closing only.”

In addition to GameStop, the new policy affects shares of BlackBerry Ltd. BB, -38.59%, AMC Entertainment Holdings Inc. AMC, -53.52%, Bed Bath & Beyond Inc. BBBY, -25.32%, Express Inc. EXPR, -51.94%, Koss Corp. KOSS, +11.72%, Naked Brand Group Ltd. NAKD, +27.90%, and American Depository Receipts for Nokia Corp. NOK, -27.56%.

Robinhood, the online trading application, is preventing users from making new purchases of several stocks, including GameStop Corp. GME, -24.03%, which have surged in value in recent weeks even as professional investors continue to hold large short positions in those securities, the company said in a blog post Thursday.

“We continuously monitor the markets and make changes where necessary,” the statement reads. “In light of recent volatility, we are restricting transactions for certain securities to position closing only.”

In addition to GameStop, the new policy affects shares of BlackBerry Ltd. BB, -38.59%, AMC Entertainment Holdings Inc. AMC, -53.52%, Bed Bath & Beyond Inc. BBBY, -25.32%, Express Inc. EXPR, -51.94%, Koss Corp. KOSS, +11.72%, Naked Brand Group Ltd. NAKD, +27.90%, and American Depository Receipts for Nokia Corp. NOK, -27.56%.

bigredfish

Known around here

This exposes just how corrupt and rigged the markets are. They are the overlords of DC and are moving in unison with the liberal Nazis in government to show us peasants who’s boss.

handinpalm

Getting comfortable

Don't worry, when there is not any more easy money to be made, they will let you trade.

Ssayer

BIT Beta Team

bigredfish

Known around here

House Speaker Nancy Pelosi says 'we'll all be reviewing' GameStop situation

I guess everyone that bought GME long will now be on the Terrorist Watchlist....

https://www.marketwatch.com/story/pelosi-says-congress-will-be-part-of-gamestop-scrutiny-2021-01-28?siteid=bnbh

I guess everyone that bought GME long will now be on the Terrorist Watchlist....

https://www.marketwatch.com/story/pelosi-says-congress-will-be-part-of-gamestop-scrutiny-2021-01-28?siteid=bnbh

Last edited: