Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ssayer

BIT Beta Team

mat200

IPCT Contributor

- Jan 17, 2017

- 16,483

- 27,705

Yup .. and on top of that .. all properties now around get property tax increases .. sooner or later we will all be renters in this game .. waiting for an ev Uber pick up

Ssayer

BIT Beta Team

This may be old news.

www.newsweek.com

www.newsweek.com

Warren Buffett selling $28.7 billion in stock rings alarm bell over economy

Buffett's Berkshire Hathaway has sold $28.7 billion in stocks during the first three quarters of 2023. Why?

Last edited:

Saw that yesterday, I think he sees a top coming and why not hoard cash in the short term when you can make a guaranteed 4-5% on it...

Ssayer

BIT Beta Team

mat200

IPCT Contributor

- Jan 17, 2017

- 16,483

- 27,705

OMG .. Great Depression v2.0 coming ...

CDs at 5% and a MM at 4.5% with local little bank. The other 1/2 of the nest egg in cash. Most of our 401Ks in MM fund. Ready for the crash.

I wish I could be playing the market, but I'm in full capital retention mode. Cant afford a 30-40% hit almost overnight like 2009 and wait 10 years to make it back!

I'm liking that 5% guaranteed money

I'm liking that 5% guaranteed money

looney2ns

IPCT Contributor

I did do some day trading a some years back, Overall I averaged about a 19% return with that.

It does take TIME to come up to speed on how and when to trade.

Don't do it unless you think you have a clue of what your doing.

But I picked something that was a little volatile, such as Ruger, Smith & Wesson, Netflix, Facebook or and others and it all worked out.

You also need to be able to take your emotions out of the decisions and keep them business based....just like most investments.

It does take TIME to come up to speed on how and when to trade.

Don't do it unless you think you have a clue of what your doing.

But I picked something that was a little volatile, such as Ruger, Smith & Wesson, Netflix, Facebook or and others and it all worked out.

You also need to be able to take your emotions out of the decisions and keep them business based....just like most investments.

Yep did my day trading apprenticeship some years back. I sucked at it!

I mean I’m not really in the market even with 401K money. I did miss some nice returns last year, but I slept better

I mean I’m not really in the market even with 401K money. I did miss some nice returns last year, but I slept better

I am with you. What people don't factor in is their loss last year into this years gain. So we made a Solid 10% on our money the last two years. Those in the Market Avged. 5% for the last 2 years. We had Zero Worries and did not have to watch the Market like a Hawk...I wish I could be playing the market, but I'm in full capital retention mode. Cant afford a 30-40% hit almost overnight like 2009 and wait 10 years to make it back!

I'm liking that 5% guaranteed money

Nails it

2024: The Year Global Government Takes Shape

2024: The Year Global Government Takes Shape | ZeroHedge

2024: The Year Global Government Takes Shape

2024: The Year Global Government Takes Shape | ZeroHedge

Regardless if you believe the made up numbers from the Govt  the bottom line is, each dollar of "growth" is costing us 150% in debt

the bottom line is, each dollar of "growth" is costing us 150% in debt

So how long would your finances last if it cost you say $150 to make $100

EVERYONE knows this is unsustainable and that we're quite near the breaking point where debt servicing will cost the US more than it takes in.

The question is what happens then?

The GDP Number Was Great... There Is Just One Huge Problem

The GDP Number Was Great... There Is Just One Huge Problem | ZeroHedge

So the next time you read something like this from the imposter in the White House...

Oh, and before we forget, a reminder that all US jobs created since 2019... have gone to foreign born workers.

So how long would your finances last if it cost you say $150 to make $100

EVERYONE knows this is unsustainable and that we're quite near the breaking point where debt servicing will cost the US more than it takes in.

The question is what happens then?

- US defaults, says to all the bagholders of our debt, "sorry, we're broke. You've lost all the money you lent us" (US bonds)

- Some "event" occurs (artificially created event) that somehow allows the US to escape paying its debt

- ?

The GDP Number Was Great... There Is Just One Huge Problem

The GDP Number Was Great... There Is Just One Huge Problem | ZeroHedge

So the next time you read something like this from the imposter in the White House...

... respond that today we also learned that our debt grew by $2.581 trillion last year. This means that every dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost futures generations of Americans $957,100.48.Today we learned that our economy grew 3.1% last year – all while adding another 2.7 million jobs and with core inflation moving back down towards the pre-pandemic benchmark.

That means wages, wealth, and employment are now higher now than they were before the pandemic. — President Biden (@POTUS) January 25, 2024

Oh, and before we forget, a reminder that all US jobs created since 2019... have gone to foreign born workers.

Sybertiger

Known around here

I don't normally read CNN to get my business info but today I did. It's in regard to the GDP that pleasantly surprised the ignorant. The reason why the USA always seems to be the unstoppable engine is the simple fact that too many people spend like drunk sailors. Now mind you, I'm not necessarily complaining about individual who do this. It's their treasure (kind of) but I'm not so much in favor of the gubermint spending all of our treasure. Great, we caused significant inflation by printing monopoly money and handing it out in the most enthusiastic and imaginative ways. No shocker there was massive fraud and waste. Like was mentioned above....every $1.00 of GDP meant $1.69 in debt. That GDP isn't looking so great anymore is it?

Last edited:

More on the above topic. There is no GROWTH. Its all a fucking charade for the naive and shallow thinkers who watch MSNBC/CNN/CBS/NBC

The only real question is how long can they continue the charade before it collapses? I'm more and more concerned about a financial apocalypse and personally trying to figure out how to stash assets out of government reach

The Great Growth Hoax

The Great Growth Hoax | ZeroHedge

.....To put a fine point on it: “Essentially, [GDP is measuring] the pace at which we’re going Soviet, replacing private wealth with government waste.” In his interpretation of the data, we are destroying wealth at the fastest rate since 2008.

An analysis by ZeroHedge echoes the same thought.

“While Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50 percent, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154 percent more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth... and it takes over $2.50 in new debt to generate $1 of GDP growth!”

To further the analysis, and doing the math: “[E]very dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost future generations of Americans $957,100.48.”

To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast. The idea of a one-income family is nearly extinct, whereas it was the norm three-quarters of a century ago. Even the gizmos are falling apart and not serving us well.

Household appliances don’t work unless you somehow get your hands on the most high-priced models. They are trying to shove everyone into urban commuter cars so that you cannot drive on those big vacations that used to be the American norm. College is out of reach and the degree is increasingly worthless anyway. People are ever more despairing for the future and thinking that this is just the new normal.

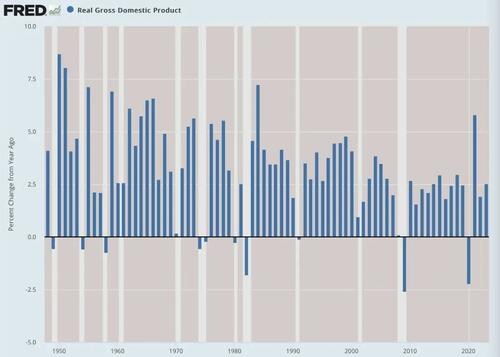

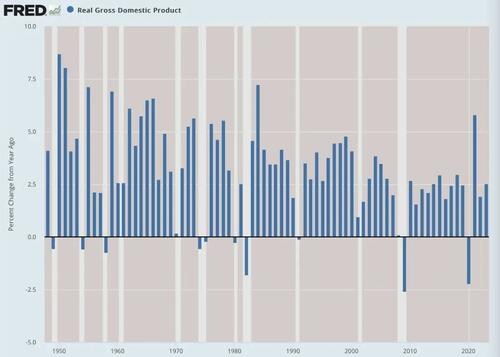

Even looking at output data over the long term, you can see the trend, even given all the manipulation and fakery. It’s still very obvious where things are headed.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

This chart reveals the history that did not need to happen. The United States has been the world center of technological innovation during these years, and the historical home for free enterprise and entrepreneurship. We should have had the greatest boom times in our history! Instead, government stole all that energy for itself. It’s a tragedy.

Everyone underestimates the wild effect of 2020 and the following chaos caused by lockdowns. Those sent the workplace into upheaval, wrecked data collection, made property rights and liberties far less secure, and entrenched a professional managerial class in government and industry that conspires against the public.

On the good side, we are seeing the evaporation of trust in media, medicine, academia, and government. Large media organizations are laying off workers in droves just to survive, and the woke agenda generally seems on the ropes.

Dramatic reforms are possible but are they likely? We will see. There needs to be wholesale reform in government and much more besides in order to save what’s left of the great American prosperity machine. As it is, the more likely outcome is to go the way of empires past, a long slog through the miasma of corruption and stagnation until generations hence will speak of the United States in the past tense the way we talk about the Portuguese empire.

That’s a big departure from the way this article opened so let’s go back to the point. The GDP data is not reflective of anything real except government profligacy and stagnation in every sector that counts. You can read the headlines or look at the underlying realities. One perpetuates existing myth-making and the other reveals that the myth is not long for this world.

The only real question is how long can they continue the charade before it collapses? I'm more and more concerned about a financial apocalypse and personally trying to figure out how to stash assets out of government reach

The Great Growth Hoax

The Great Growth Hoax | ZeroHedge

.....To put a fine point on it: “Essentially, [GDP is measuring] the pace at which we’re going Soviet, replacing private wealth with government waste.” In his interpretation of the data, we are destroying wealth at the fastest rate since 2008.

An analysis by ZeroHedge echoes the same thought.

“While Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50 percent, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154 percent more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth... and it takes over $2.50 in new debt to generate $1 of GDP growth!”

To further the analysis, and doing the math: “[E]very dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost future generations of Americans $957,100.48.”

To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast. The idea of a one-income family is nearly extinct, whereas it was the norm three-quarters of a century ago. Even the gizmos are falling apart and not serving us well.

Household appliances don’t work unless you somehow get your hands on the most high-priced models. They are trying to shove everyone into urban commuter cars so that you cannot drive on those big vacations that used to be the American norm. College is out of reach and the degree is increasingly worthless anyway. People are ever more despairing for the future and thinking that this is just the new normal.

Even looking at output data over the long term, you can see the trend, even given all the manipulation and fakery. It’s still very obvious where things are headed.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

This chart reveals the history that did not need to happen. The United States has been the world center of technological innovation during these years, and the historical home for free enterprise and entrepreneurship. We should have had the greatest boom times in our history! Instead, government stole all that energy for itself. It’s a tragedy.

Everyone underestimates the wild effect of 2020 and the following chaos caused by lockdowns. Those sent the workplace into upheaval, wrecked data collection, made property rights and liberties far less secure, and entrenched a professional managerial class in government and industry that conspires against the public.

On the good side, we are seeing the evaporation of trust in media, medicine, academia, and government. Large media organizations are laying off workers in droves just to survive, and the woke agenda generally seems on the ropes.

Dramatic reforms are possible but are they likely? We will see. There needs to be wholesale reform in government and much more besides in order to save what’s left of the great American prosperity machine. As it is, the more likely outcome is to go the way of empires past, a long slog through the miasma of corruption and stagnation until generations hence will speak of the United States in the past tense the way we talk about the Portuguese empire.

That’s a big departure from the way this article opened so let’s go back to the point. The GDP data is not reflective of anything real except government profligacy and stagnation in every sector that counts. You can read the headlines or look at the underlying realities. One perpetuates existing myth-making and the other reveals that the myth is not long for this world.

I suspect most Democrats and not so few Republicans have no clue what comes next...