$2.7 Trillion Buys "Spectacular" GDP

$2.7 Trillion Buys "Spectacular" GDP | ZeroHedge

GDP vs Wealth

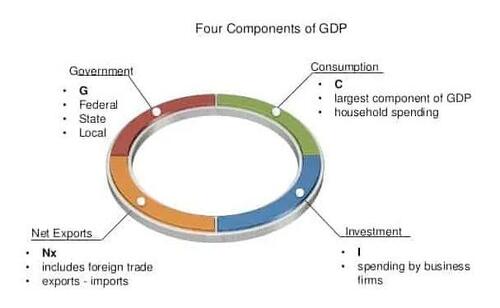

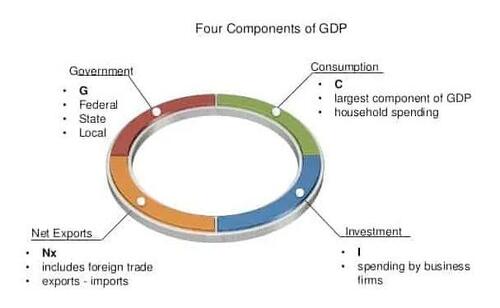

Remember that GDP isn’t measuring wealth, it’s measuring spending — production which is sold.

As

Megan McArdle put it, GDP “counts the dollar value of our output, but not the actual improvement in our lives, or even in our economic condition.”

For example, if you dig holes and fill them, it’s GDP. In fact, you could build a missile, blow up the Golden Gate Bridge and every house within 5 miles of it, and it shows up as GDP. The missile cost money after all, and the government paid for it.

Of course, mainstream media — indeed, mainstream economics — pretends that GDP is identical to wealth. Pumping out articles celebrating GDP as prosperity.

That’s close enough when it’s private firms or individuals producing more to sell more — in that case, rising GDP means the country is getting richer. Because more stuff is being produced.

But it’s actually the opposite when it’s government spending. Because government’s job is taking wealth and lighting it on fire. That means when GDP is growing from government spending it’s not measuring wealth.

It’s measuring dissipation of wealth at best, destruction of wealth at worst.

Essentially, the pace at which we’re going Soviet, replacing private wealth with government waste.

So translating that brave and stunning GDP into the real world, we’re destroying wealth at rates not seen since 2008.

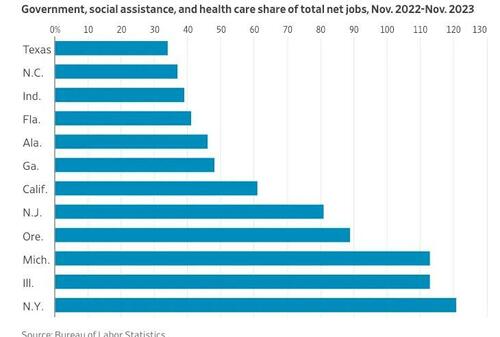

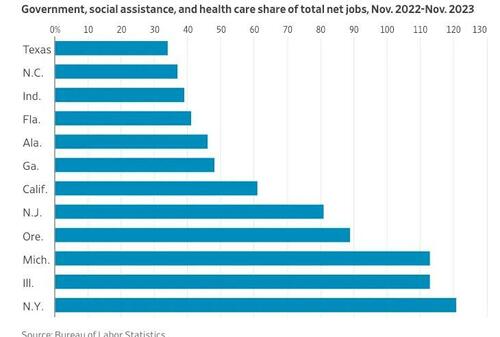

This actually lines up with what we’ve seen in jobs — in a recent video I mentioned that over half the jobs last year were actually government and government-related social service jobs.

In some states it was literally more than all the jobs created — in other words, the private sector is shrinking.

All these government jobs, of course, are unproductive — they’re not making us more prosperous as a society.

On the contrary, they’re taking wealth earned from productive activities and squandering them on vote-buying or worse — think of the wealth-destruction contained in a single EPA bureaucrat.

Jokes on me...LOL!

Jokes on me...LOL!