Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

looney2ns

IPCT Contributor

looney2ns

IPCT Contributor

Wasn't sure as I couldn't read your Bourbon fueled mind.LOL both of you, thanks!

Sybertiger

Known around here

401(k) hardship withdrawals on the upswing as inflation squeezes consumers

More Americans are making hardship withdrawals from their 401(k) retirement plans to cover expenses as they struggle with chronic inflation.

Sybertiger

Known around here

Too bad we can't send them some of our inflation to help them out.

www.foxbusiness.com

www.foxbusiness.com

China slides into deflation in potentially worrying sign for global economy

As many countries deal with crippling inflation, China is seeing month-on-month declines in consumer prices and spending stoking anxiety among investors and trading partners.

Forget CPI: Inflation In Necessities Has Skyrocketed Since 2020

Forget CPI: Inflation In Necessities Has Skyrocketed Since 2020 | ZeroHedge

When mainstream economists and politicians cite “improvements” to the inflation problem in the US in recent months, what they are commonly referencing are changes to the Consumer Price Index (CPI). However, the CPI is not a measure of total inflation, rather, it is a median snapshot of prices at a particular point and time. True inflation is cumulative – A 10% increase one year and a 5% increase the next year is not a win, it means that you are now paying 15% more on average for everything you buy in the span of only two years.

When CPI falls this does not mean that prices on goods and services are going down, it only indicates that prices are rising slower than they were the month or the year before.

Forget CPI: Inflation In Necessities Has Skyrocketed Since 2020 | ZeroHedge

When mainstream economists and politicians cite “improvements” to the inflation problem in the US in recent months, what they are commonly referencing are changes to the Consumer Price Index (CPI). However, the CPI is not a measure of total inflation, rather, it is a median snapshot of prices at a particular point and time. True inflation is cumulative – A 10% increase one year and a 5% increase the next year is not a win, it means that you are now paying 15% more on average for everything you buy in the span of only two years.

When CPI falls this does not mean that prices on goods and services are going down, it only indicates that prices are rising slower than they were the month or the year before.

Sybertiger

Known around here

Wow, didn't know wheat is more expensive than beef (per lb).

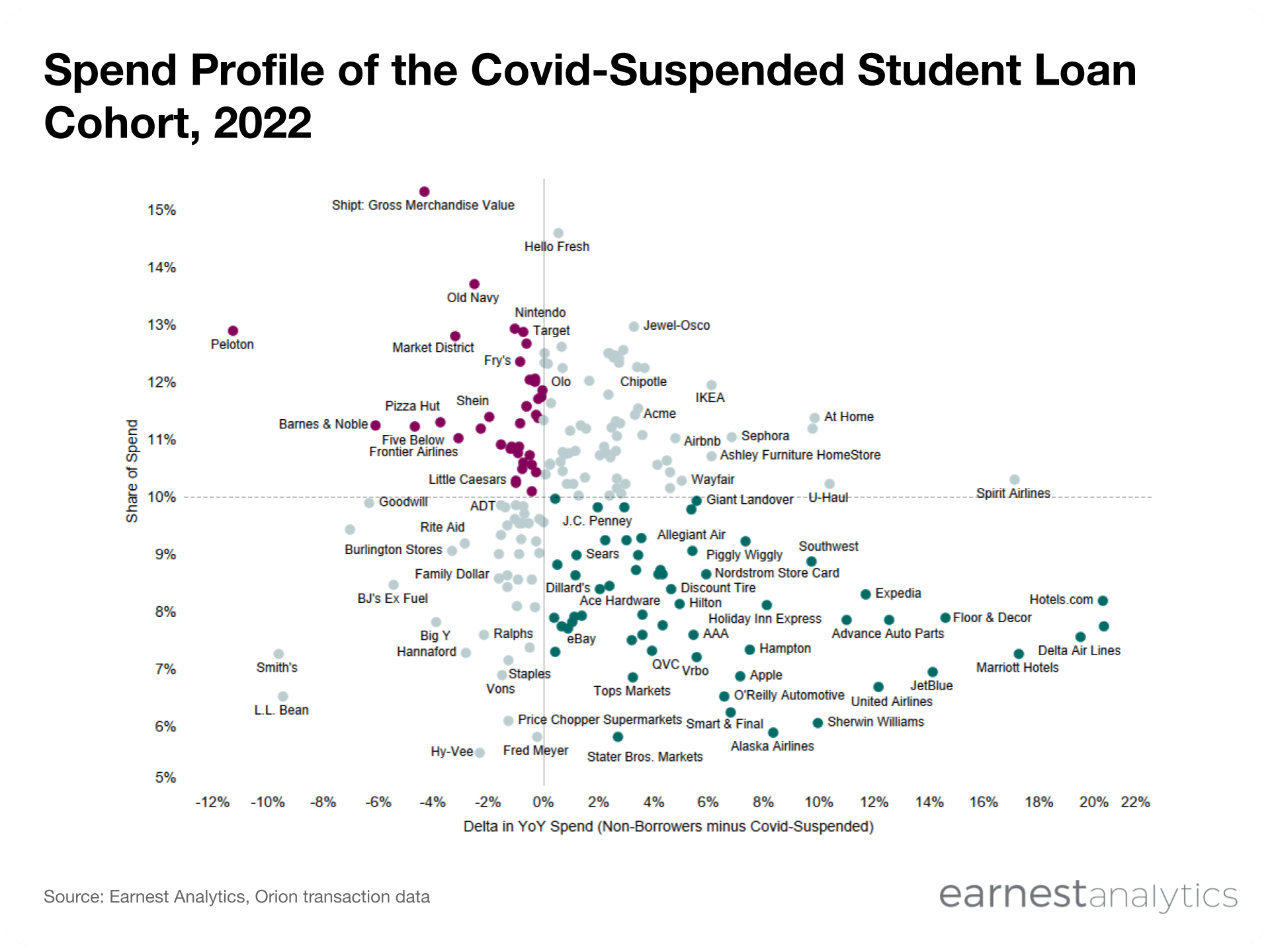

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls | ZeroHedge

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls | ZeroHedge

Sybertiger

Known around here

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls | ZeroHedge

Corrupt vote buying politicians will probably figure out a way for further forebearance or forgiveness.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,494

- 27,709

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls

Corporate America Panics As 'Student Loan' Chatter Hits Record On Earnings Calls | ZeroHedge

interesting .. Fry's is on the graphic .. yet iirc Fry's is out of business ..

Sybertiger

Known around here

Frontier, Peloton, and Old Navy among More Exposed Brands As Student Loan Payments set to Resume - Earnest Analytics

Student loan payers who suspended payments during Covid will have to resume those payments come October. What does that mean for consumer spend?

interesting .. Fry's is on the graphic .. yet iirc Fry's is out of business ..

View attachment 170736

View attachment 170737

The now Kroger owned food store by the same name and same family mebbe?

You know things are bad when….

"I Just Want To Sell Titty Pictures": Sex Workers F**ked By Crypto

www.zerohedge.com

www.zerohedge.com

"I Just Want To Sell Titty Pictures": Sex Workers F**ked By Crypto

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Sybertiger

Known around here

I wonder how some who are just starting off with a new home would feel about 9% or higher like many of us dealt with when purchasing a home when we were first starting out. I was at 9% and I know others who had higher rates.

Not only that but property taxes have skyrocketed in many places so the local gov't. can fund so many useless projects and hand money hand-over-fist to every "disadvantaged", whiny group that comes along with their hands out.I wonder how some who are just starting off with a new home would feel about 9% or higher like many of us dealt with when purchasing a home when we were first starting out. I was at 9% and I know others who had higher rates.

I know of a modest, average sized, single story 40 year old home in San Jose, CA in a nice neighborhood that probably cost $60K when built in 1980 that is appraised now at $1.5M and the owner pays....brace yourself.....$20K in property taxes annually.

The fact that it's in CA should speak volumes about why most of those tax increases have occurred. Thank you, Lord...for getting me outta there in '04.

9.5% for me. I was able to pay off my 30 in 22 years...the mortgage company came up with a plan, instead of paying monthly, we paid every two weeks, 26 payments a year. I think it started out where we paid an extra $40 a month. Anyway, we paid it off in 22 years...I wonder how some who are just starting off with a new home would feel about 9% or higher like many of us dealt with when purchasing a home when we were first starting out. I was at 9% and I know others who had higher rates.

We looked into refinancing but instead of starting a new 30 year loan to save monthly, we passed...plus I think they wanted 2 or 3 points up front to get a 6% loan...glad we passed. There is a huge satisfaction in paying off a house mortgage...

It was below 3% when Trump was in office.