The wife use to watch those shows where they come in to help a family in need to renovate their house, well they actually end up tearing down the house a building a new one. Now the needy family has a huge property tax and utility bill...Not only that but property taxes have skyrocketed in many places so the local gov't. can fund so many useless projects and hand money hand-over-fist to every "disadvantaged", whiny group that comes along with their hands out.

I know of a modest, average sized, single story 40 year old home in San Jose, CA in a nice neighborhood that probably cost $60K when built in 1980 that is appraised now at $1.5M and the owner pays....brace yourself.....$20K in property taxes annually.

The fact that it's in CA should speak volumes about why most of those tax increases have occurred. Thank you, Lord...for getting me outta there in '04.

Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why You Are Feeling So Much Poorer

Why You Are Feeling So Much Poorer | ZeroHedge

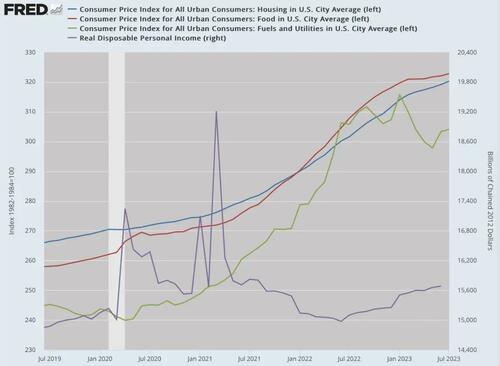

What do you spend money on month-to-month? It’s rent or your mortgage, food at home or out, utilities, and gas. Those are the basic categories. The Consumer Price Index includes far more than that, some items you do not purchase and some that are going up far less than others. So let’s look at government numbers on what you actually purchase; that is, the items and services that you consume that dominate part of your income. And let’s stretch that back three years.

Everything is going up and up and has been for three years. Looking at the items on which you actually spend money, we find increases between 18-plus percent to 22-plus percent. Let’s say we average it all out at 20 percent.

Now let’s look at real disposable income, which is income left over after expenses adjusted for inflation. That result is an increase of a pathetic 3 percent compared with three years ago. The stimulus payments felt great at the time but those are long gone, essentially a head fake. So your income demands are up 20 percent whereas your leftover cash is barely up at all. That’s essentially a disaster for your standard of living.

In short, you have been robbed.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Why You Are Feeling So Much Poorer | ZeroHedge

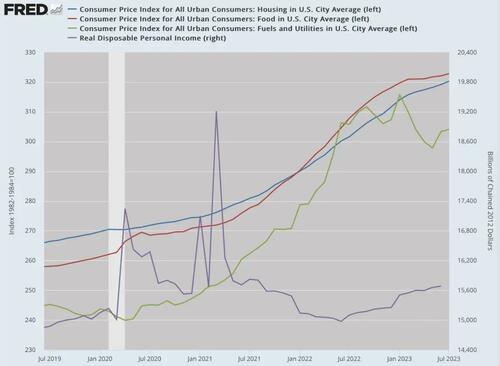

What do you spend money on month-to-month? It’s rent or your mortgage, food at home or out, utilities, and gas. Those are the basic categories. The Consumer Price Index includes far more than that, some items you do not purchase and some that are going up far less than others. So let’s look at government numbers on what you actually purchase; that is, the items and services that you consume that dominate part of your income. And let’s stretch that back three years.

Everything is going up and up and has been for three years. Looking at the items on which you actually spend money, we find increases between 18-plus percent to 22-plus percent. Let’s say we average it all out at 20 percent.

Now let’s look at real disposable income, which is income left over after expenses adjusted for inflation. That result is an increase of a pathetic 3 percent compared with three years ago. The stimulus payments felt great at the time but those are long gone, essentially a head fake. So your income demands are up 20 percent whereas your leftover cash is barely up at all. That’s essentially a disaster for your standard of living.

In short, you have been robbed.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)Unemployment Rate Unexpectedly Surges As BLS Revises Payrolls For Every Month In 2023 Sharply Lower

Unemployment Rate Unexpectedly Surges As BLS Revises Payrolls For Every Month In 2023 Sharply Lower | ZeroHedge

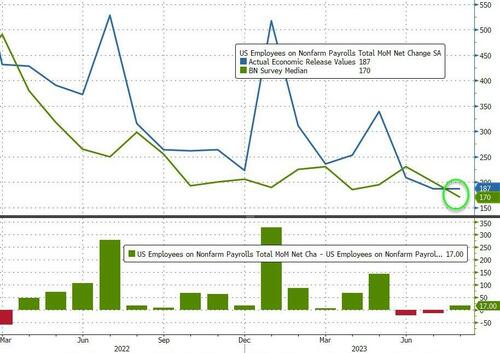

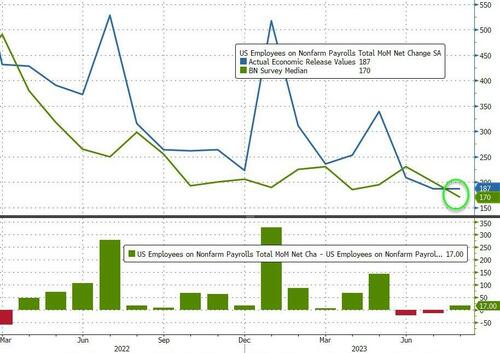

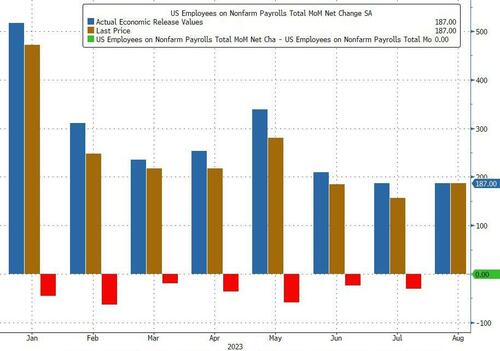

Ahead of today's payrolls report consensus was already ugly enough, with some of the largest banks expecting a number well below expectations (JPM was at 125K, Citi at 130K, Goldman at 149K vs median consensus of 170K). And while moments ago we got a number which was at least nominally stronger than expected, the report in general was weak enough to suggest that - as we expected - the wheels are finally coming off the US labor market (as this week's JOLTS report strongly hinted).

With that preamble out of the way, moments ago Biden's BLS (Bureal Of Lies and Statistics) reported that in August, the US added 187K jobs, and beating the consensus estimate of 170K...

Superficially this would have meant an unchanged print from last month when the BLS also reported 187K jobs, however in keeping with recent trends that number was revised - drumroll - lower again, to 157K, meaning that every single monthly payrolls print in 20-23 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

But wait there's more: while July was revised down by 30K from +187,000 to +157,000, June was revised even more, by 80,000, from +185,000 to +105,000, which means that a number that was originally reported as 209K has been reivsed 50% lower, to 105K and a collapse vs original expectations of 230K. Here, the BLS was proud to report that "with these revisions, employment in June and July combined is 110,000 lower than previously reported."

In other words, we now wait for the August payrolls number to be revised sharply lower as well because that's how Biden's handlers roll.

Unemployment Rate Unexpectedly Surges As BLS Revises Payrolls For Every Month In 2023 Sharply Lower | ZeroHedge

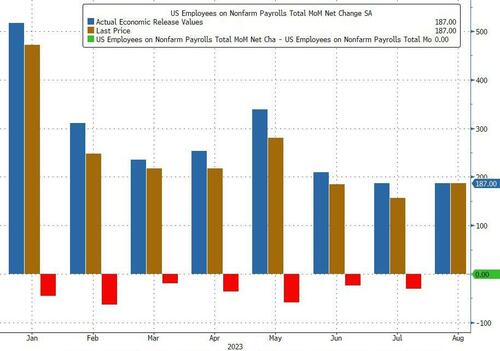

Ahead of today's payrolls report consensus was already ugly enough, with some of the largest banks expecting a number well below expectations (JPM was at 125K, Citi at 130K, Goldman at 149K vs median consensus of 170K). And while moments ago we got a number which was at least nominally stronger than expected, the report in general was weak enough to suggest that - as we expected - the wheels are finally coming off the US labor market (as this week's JOLTS report strongly hinted).

With that preamble out of the way, moments ago Biden's BLS (Bureal Of Lies and Statistics) reported that in August, the US added 187K jobs, and beating the consensus estimate of 170K...

Superficially this would have meant an unchanged print from last month when the BLS also reported 187K jobs, however in keeping with recent trends that number was revised - drumroll - lower again, to 157K, meaning that every single monthly payrolls print in 20-23 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

But wait there's more: while July was revised down by 30K from +187,000 to +157,000, June was revised even more, by 80,000, from +185,000 to +105,000, which means that a number that was originally reported as 209K has been reivsed 50% lower, to 105K and a collapse vs original expectations of 230K. Here, the BLS was proud to report that "with these revisions, employment in June and July combined is 110,000 lower than previously reported."

In other words, we now wait for the August payrolls number to be revised sharply lower as well because that's how Biden's handlers roll.

Sybertiger

Known around here

Wow, that's sad. I gotta believe that for a certain large chuck of folks it's self inflicted.

www.foxbusiness.com

www.foxbusiness.com

All income brackets now living paycheck to paycheck: Study

Paycheck-to-paycheck living isn't anything new, but the troubling trend is now impacting more Americans than ever as rising borrowing costs and inflation take a toll.

mat200

IPCT Contributor

- Jan 17, 2017

- 16,520

- 27,762

mat200

IPCT Contributor

- Jan 17, 2017

- 16,520

- 27,762

Bitcoin et al .. it will be crypto they confiscate ..

mat200

IPCT Contributor

- Jan 17, 2017

- 16,520

- 27,762

Hey there, thanks for sharing the insights on the unemployment rate and the revisions in payrolls – it's quite a rollercoaster in the job market lately!

Hi GilbertFlores ..

What types of jobs have you been looking for ?

Two unsettling stories amid a continuing mountain of unsettling stories about the US economy..

Slide In Consumer Credit Accelerates As Excess Savings Exhausted, Average Credit Card Rate Hits 22% | ZeroHedge

Small US Banks Suffer Biggest Deposit Outflows Since SVB Crisis, Money-Market Inflows Soar | ZeroHedge

Slide In Consumer Credit Accelerates As Excess Savings Exhausted, Average Credit Card Rate Hits 22% | ZeroHedge

Small US Banks Suffer Biggest Deposit Outflows Since SVB Crisis, Money-Market Inflows Soar | ZeroHedge

I know of a building like that close to Houston (Woodlands), I know I have seen at least 5 different restaurants there, one was even a Bennigan's several years after they all closed down.- YouTube

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.www.youtube.com

I do miss Bennigans, especially their fried cheese and pretty good bar

Steak and Ale too, for the wife and II do miss Bennigans, especially their fried cheese and pretty good bar

Yep, had a few in Jasper, AL like that, well before COVID hit in March of '20......we call those unlucky locations "snakebit."- YouTube

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.www.youtube.com

Last edited:

Our town is still growing. The only thing that has changed is the Bank!

So far about 5 names in the last few years.

Even our WallyWorld is still clean!

So far about 5 names in the last few years.

Even our WallyWorld is still clean!

TLDR... apologies if this has already been posted.

This is the appropriate strategy for most people.

Investment Order

This is the appropriate strategy for most people.

Investment Order

tigerwillow1

Known around here

There was a discussion a few weeks ago about medicare and medicaid ballooning in the federal budget. It was in the electric car thread and I don't want to continue it there. Anyway, here's yet another reason for medicaid costing more.

Oregon plans to use Medicaid money for rental assistance for those who qualify

And from other tax money in Multnomah county, Oregon:

CARTOON: ALL THE HOMELESS FREE STUFF YOUR TAXES PAY FOR

Oregon plans to use Medicaid money for rental assistance for those who qualify

And from other tax money in Multnomah county, Oregon:

CARTOON: ALL THE HOMELESS FREE STUFF YOUR TAXES PAY FOR

mat200

IPCT Contributor

- Jan 17, 2017

- 16,520

- 27,762

There was a discussion a few weeks ago about medicare and medicaid ballooning in the federal budget. It was in the electric car thread and I don't want to continue it there. Anyway, here's yet another reason for medicaid costing more.

Oregon plans to use Medicaid money for rental assistance for those who qualify

And from other tax money in Multnomah county, Oregon:

View attachment 171903

CARTOON: ALL THE HOMELESS FREE STUFF YOUR TAXES PAY FOR

I expect the biggest contributor to the medicare and medicaid is the aging population of the USA ..